San Francisco Bay Area Commercial Real Estate Update - Q4 2021

This newsletter provides you with commercial real estate market research, guidance, and opportunities in the San Francisco Bay Area. Contact us with any questions regarding current market conditions.

Industrial - Record Levels of Demand Push Vacancy Rates to All-Time Lows in Several Markets

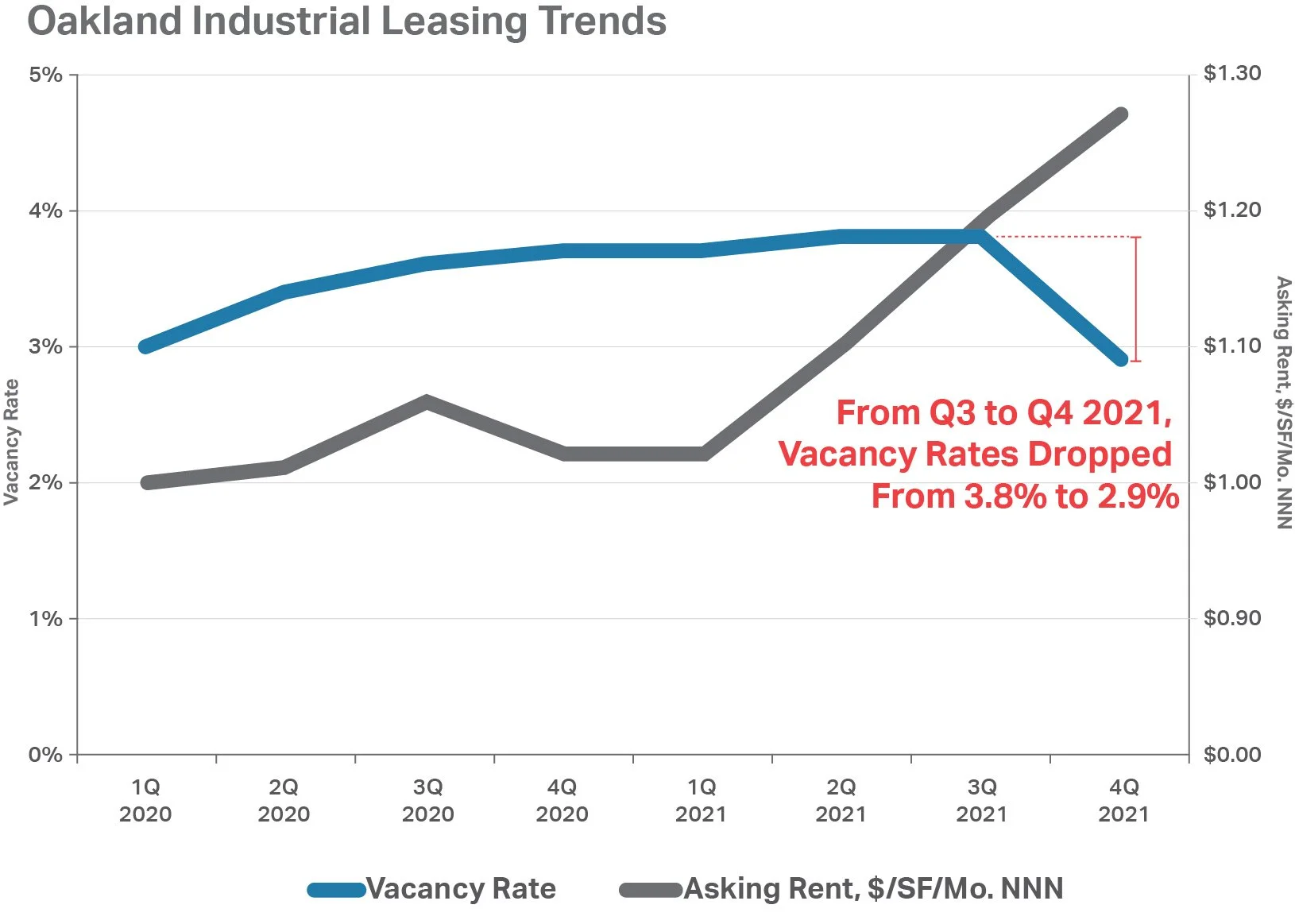

The Peninsula and Oakland industrial markets lead the charge as businesses continue to absorb space at an astonishing rate. The Oakland/Richmond market is especially hot, where vacancy rates for industrial property along the I-80 and I-880 Corridor dropped to an astonishing 2.9% in Q4 2021 from 3.8% in Q3 2021. Major transactions in that region included leases from Amazon, Fedex, and Manheim. Average Asking Rates for industrial space in the Oakland market also shot up significantly, from $1.19 NNN to $1.27 NNN. Approximately 1.9 million SF of industrial space is currently under construction.

In the Peninsula, net absorption for warehouse properties totaled a sizeable 472,000 SF in Q4 2021.

Oakland Industrial Trends

Multifamily - Promising Signs of Recovery Throughout the Bay Area.

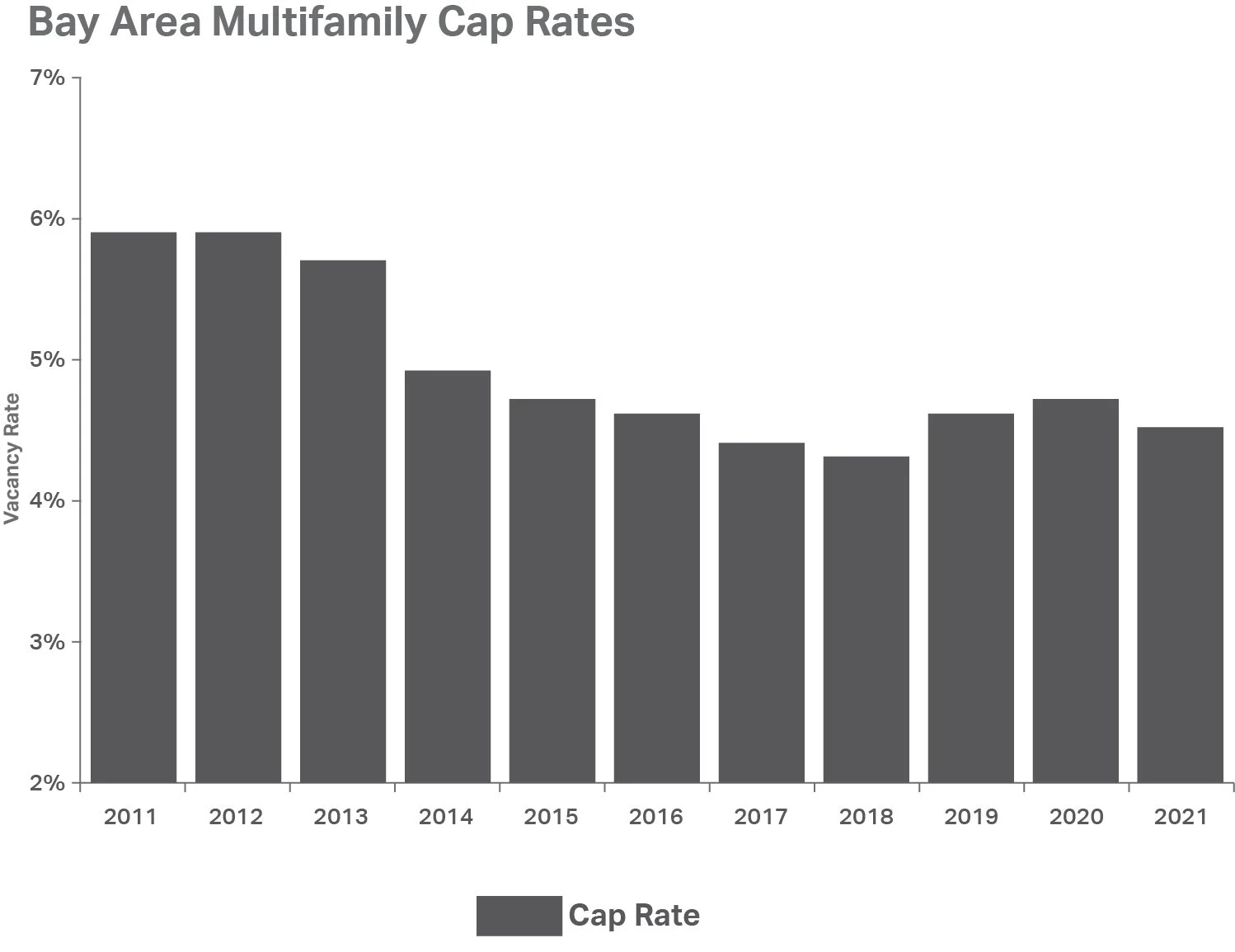

One of the most promising signs of recovery has been the significant absorption of vacant units. Vacancy rates in the Bay Area have dropped more than 31% compared to Q4 of 2020, from 8.0% to 5.5%. Cap rates have lowered yet average asking rents have increased, signaling a healthy demand for units and renewed desire to live in the Bay Area.

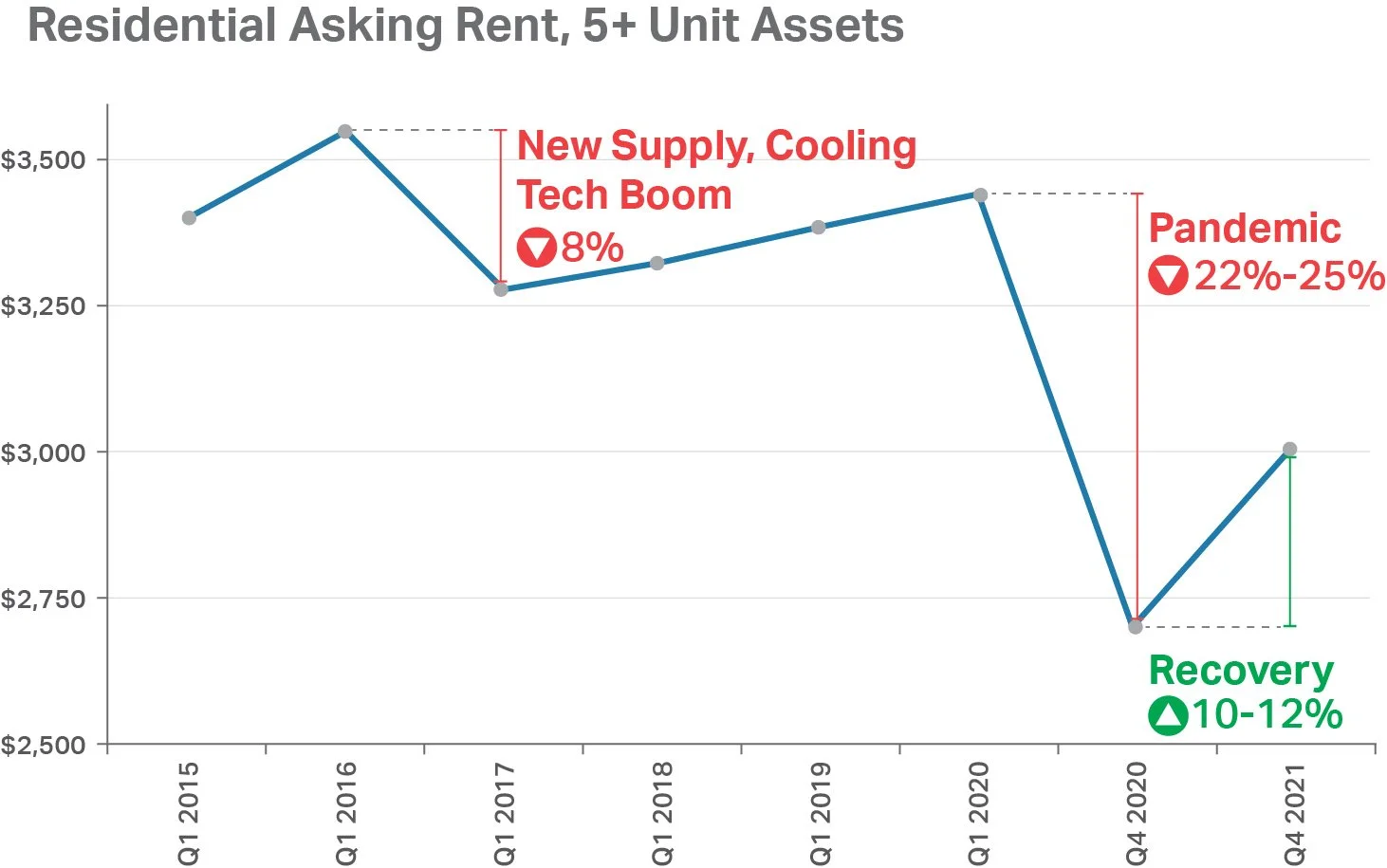

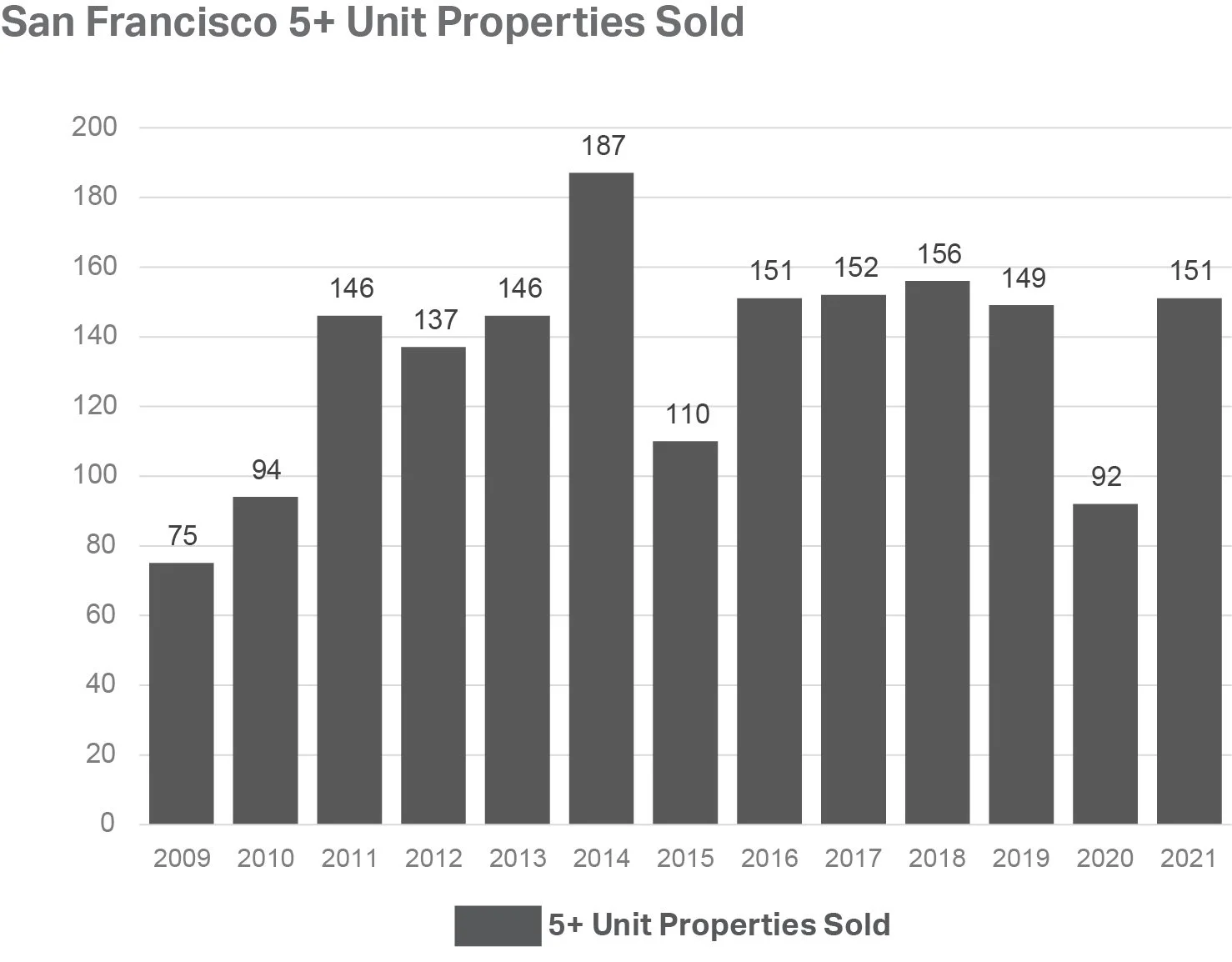

The San Francisco multifamily market has also bounced back from much of its decline, though the recovery has been somewhat muted compared to the rest of the Bay Area and major markets around the country.

Bay Area Residential Asking Rents, 5+ Unit Assets

Residential Asking Rents, 5+ Units, San Francisco

San Francisco 5+ Unit Properties Sold

Office - Return to Office Delays Dampen Recovery, Vacancy Stays Relatively Flat Across Bay Area Markets with Some Standouts

The market for office space was relatively brisk in the Bay Area - most markets posted near zero net absorption. However, two markets have had a standout fourth quarter. The South Bay posted positive net absorption of nearly 500,000 SF bolstered by leases from Yahoo (603,000 SF), Citrix (311,000 SF), and Tibco (292,000 SF). The Peninsula posted positive net absorption of 355,000 SF in Q4 of 2021 and 2,704,000 SF in all of 2021. Much of the new leases in this market are from rapidly expanding tech, life sciences, and R&D companies like Genentech, Impossible Foods, and Meta.

The San Francisco and East Bay markets both experienced negative net absorption for the fourth quarter, mostly due to a lack of major new leases; San Francisco posted on two leases larger than 100,000 SF (Blackrock - 204,000 SF, Vir Biotechnology - 134,000 SF) while Oakland had none.

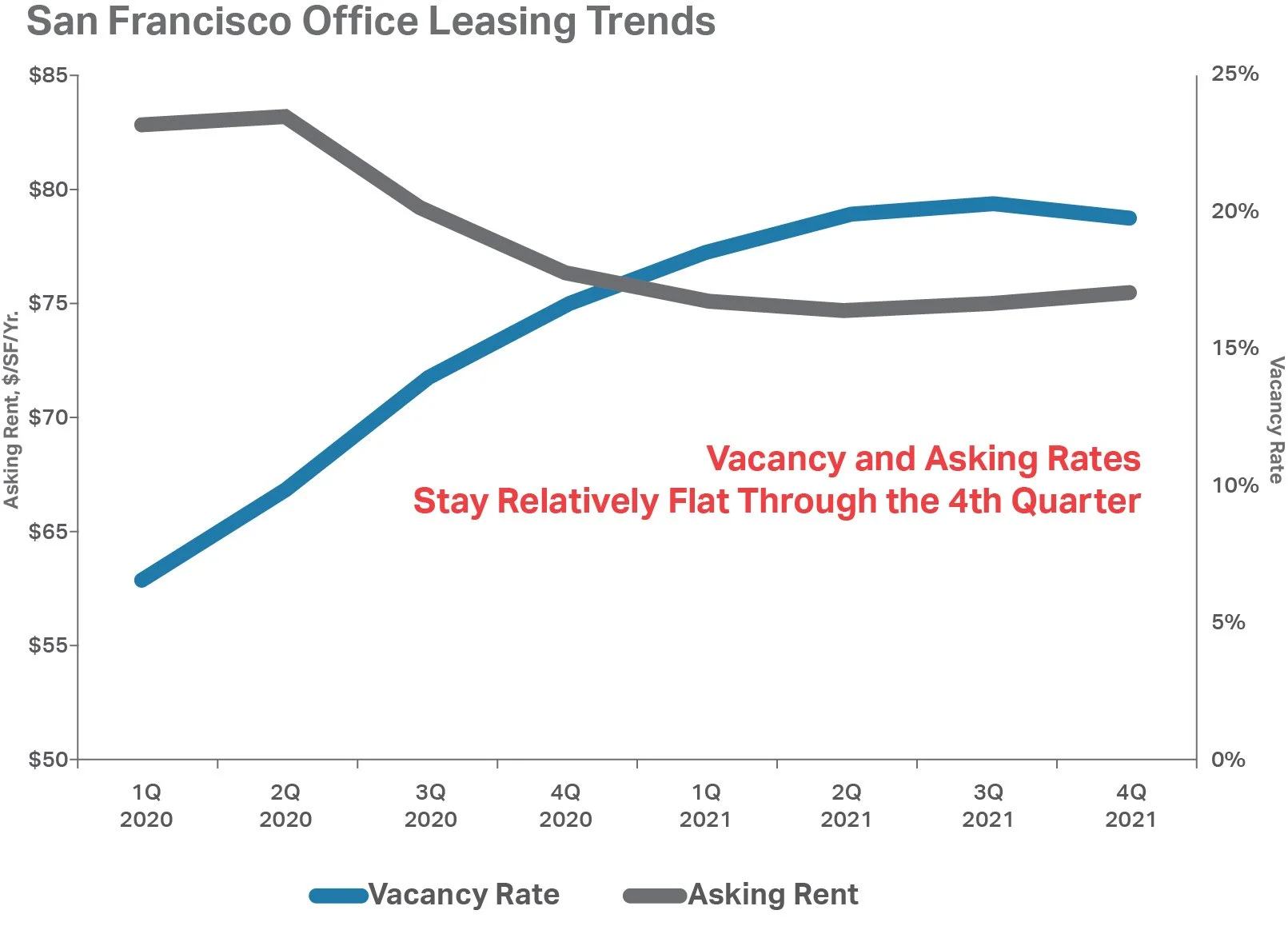

San Francisco Overall Vacancy and Asking Rents

Hospitality - A Wave of New Hotel Openings Signals Renewed Confidence in Bay Area Hospitality

When COVID-19 restrictions began in 2020, construction of hotels nearly came to a complete halt. In 2021, developers felt comfortable enough to complete many of their projects that were delayed. As a result, nearly 2,900 rooms were delivered in all of 2021, more than double the deliveries of 2020.

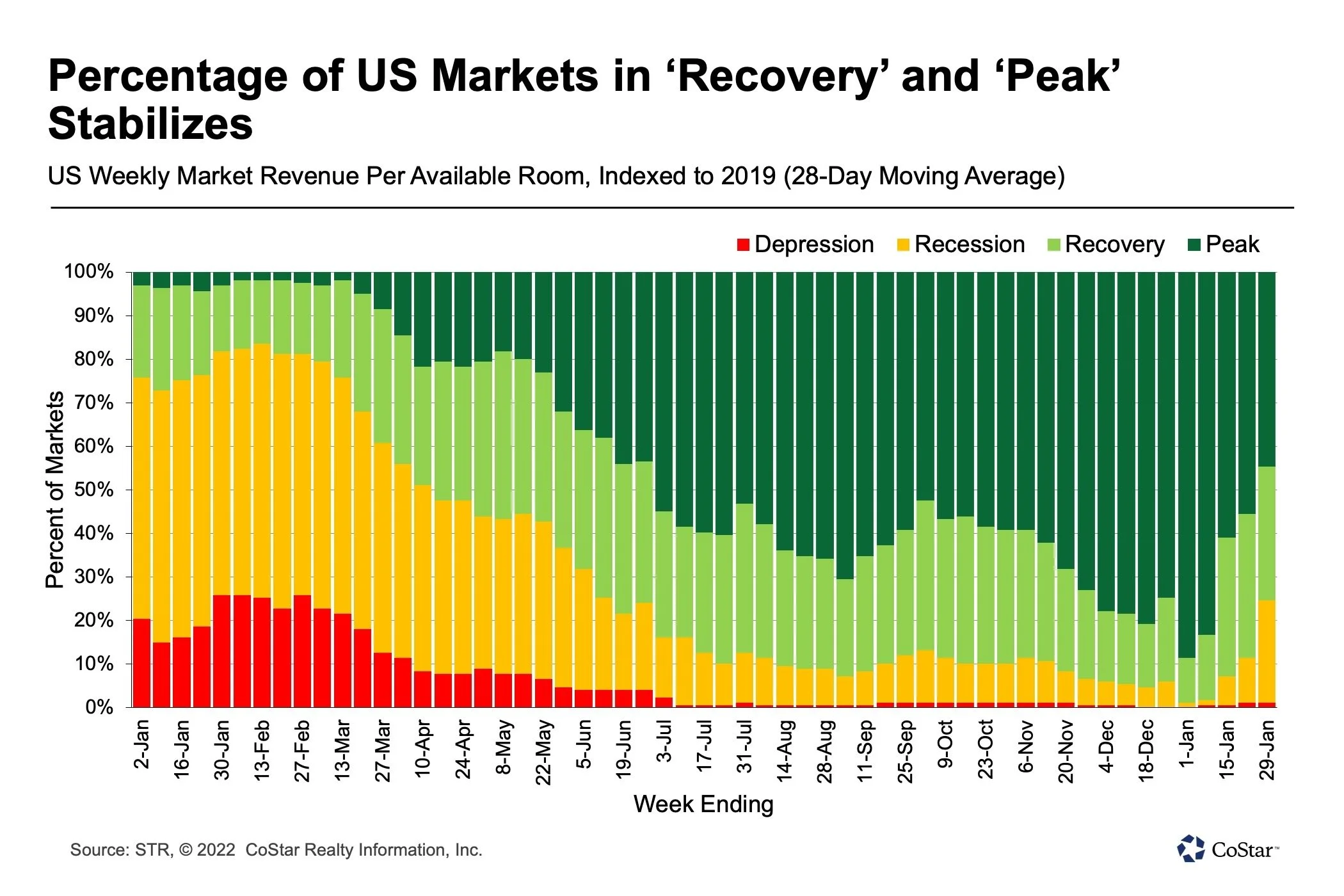

Based on a recent report by CoStar and STR, hotels are generally performing better with fewer markets in a recession/depression based on Revenue Per Available Room, a standard measure of income performance for hotels.

US Weekly Market Revenue Per Available Room, Indexed to 2019 (28-Day Moving Average)

Retail - State and Local Government Subsidies and Support Programs Ease Burdens of Retailers

Locally, the financial support for local retail businesses has helped soften the blow from COVID-19. In San Francisco, retail vacancy is still increasing, though at a slower rate. Vacancy rates citywide in Q4 2021 rose to 5.4% from 4.8% in Q4 2020. Union Square vacancy dropped from 14.5% in Q3 to 14.0% in Q4, boosted by major leases such as Yves Saint Laurent at 90 Grant Avenue and The Art of the Brick Exhibition at One Grant Avenue. The investment market was also positively shocked in Q4 when 340 Post Street, currently a Williams Sonoma flagship, was sold to fashion retailer Chanel for $63 million, while neighboring 384 Post Street, anchored by Saks Fifth Avenue, was sold for $156 million. These are certainly signs of confidence in the beaten down Union Square submarket.

Nationally, retail properties recovered well with a record breaking holiday shopping season that significantly boosted net absorption and dropped the vacancy rate to 6.5%. According to Moody’s, retail and restaurant sales increased to $1.92 trillion in Q4 2021 from $1.63 trillion in Q4 2020, an increase of 18.4%. Meanwhile, there has been a noticeable plateau in sales figures for online retailers, a sign that the threat of online encroachment into the brick and mortar space is slowing.

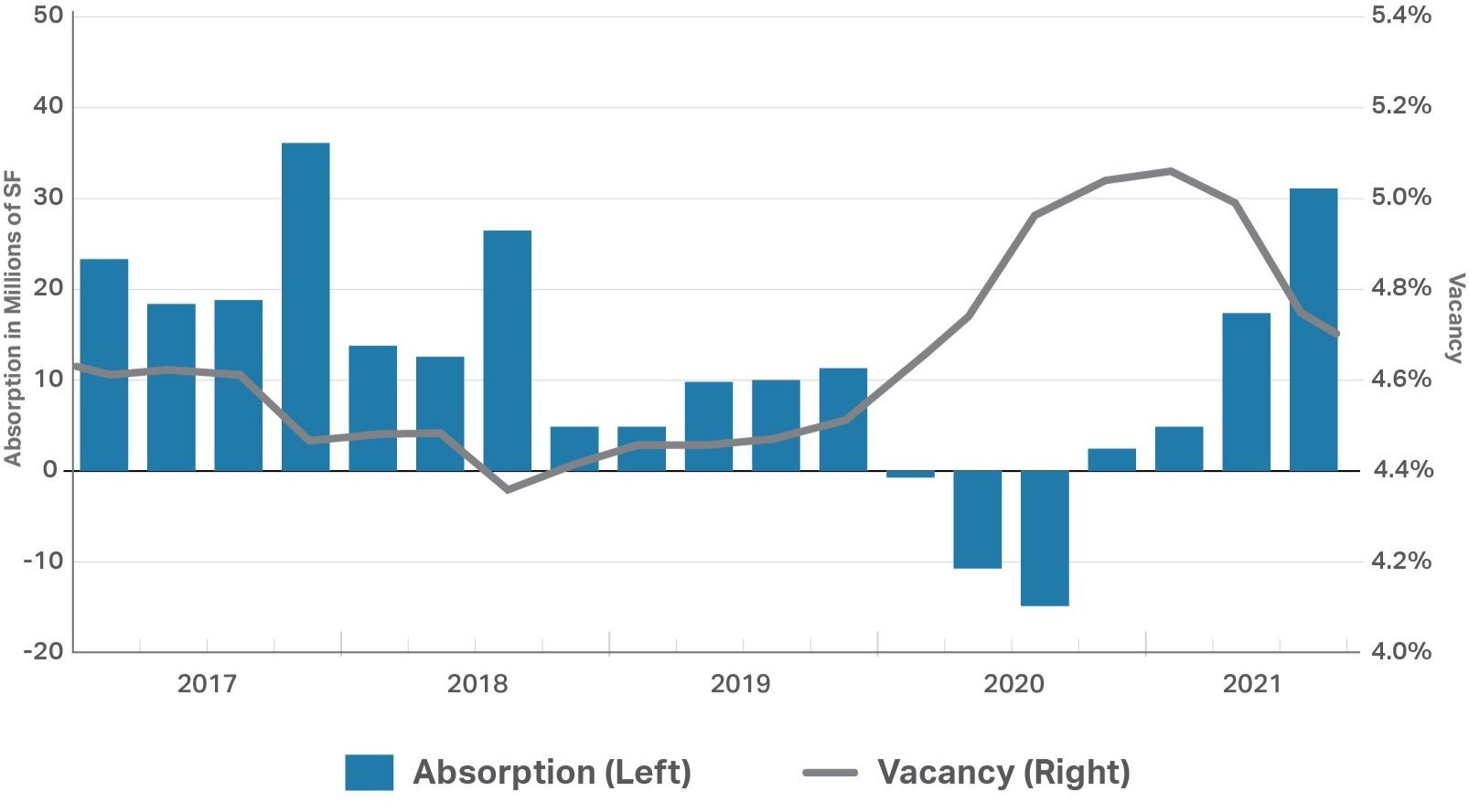

US Retail Leasing - Net Absorption and Vacancy Rates

Overall Bay Area Economic Health

The Bay Area has recovered roughly half of its labor force since the beginning of COVID-19 restrictions. The unemployment rate now rests at 3.5%, compared to 2.4% at its lowest during the holiday season of 2019.

Unemployment Rate, San Francisco - Oakland - Hayward Metropolitan Statistical Area

(Not Seasonally Adjusted)

Let's Catch Up

How are your assets performing? What have been your pain points? How can we help? Let's discuss -

Call 415-278-7838

or

Featured LL CRE Group Listings

1300 Van Ness Avenue

San Francisco, CA

An Icon, Poised for Transformation

Legislative Update - San Francisco Residential Vacancy Tax May Arrive in November Ballot

A simple majority is needed in November to pass the proposed residential vacancy tax in San Francisco for properties with 3 or more residential units. The bill was introduced early February of 2022 by Supervisor Dean Preston, shortly after his office published a report that 40,000+ residential units were vacant in the city (a number that is debatably inflated by temporarily “vacant” units).

Recent LL CRE Group Transactions

1074 Union Street

San Francisco, CA

14-Unit Multifamily

932 Cabrillo Street

San Francisco, CA

6-Unit Multifamily

936 Geary Street

San Francisco, CA

33-Unit Mixed-Use

Contact Us for More Information

Brian Leung

Senior Vice President

(O) 415.278.7838

Brian@LL-CRE.com

CA License No. 01203473

Jeremy Lee

Senior Vice President

(O) 415.988.9719

Jeremy@LL-CRE.com

CA License No. 01951309