San Francisco Bay Area Commercial Real Estate Update - Q3 2021

This newsletter provides you with commercial real estate market research, guidance, and opportunities in the San Francisco Bay Area. Contact us with any questions regarding current market conditions.

Industrial - Strong E-Commerce Demand Continues to Drive Record Breaking Expansion of This Product Throughout the Region

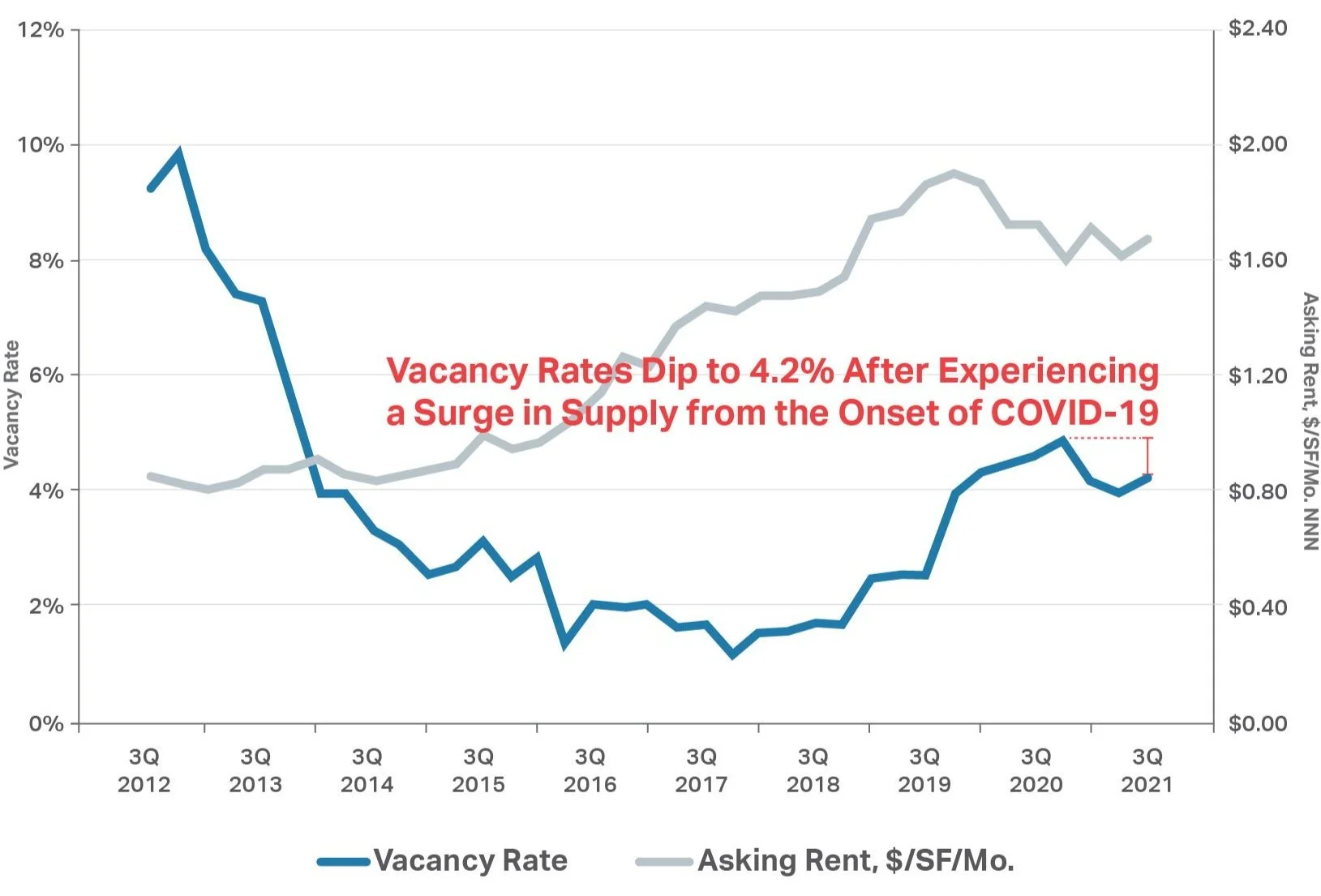

The Bay Area’s supply for industrial space continues to shrink. The East Bay leads the way with a remarkable 3.8% vacancy rate at the end of the 3rd quarter. The consistently elevated demand for the product in the last few years has lead to a major construction rush - there is currently 1,619,000 SF of industrial space under construction in the East Bay. Meanwhile the second largest industrial market in the Bay, the Peninsula, has only just begun to recover from the impacts of COVID. Average asking rental rates for industrial space in the Peninsula increased from $1.62/SF/Mo. NNN to $1.68/SF/Mo. Vacancy rates have dropped from 4.6% in Q3 of 2020 to 4.2% in Q3 of 2021.

San Mateo County (Peninsula) Industrial Trends

Multifamily - Continues to Regain Traction. Sales Activity Up Significantly Compared to Same Time Last Year.

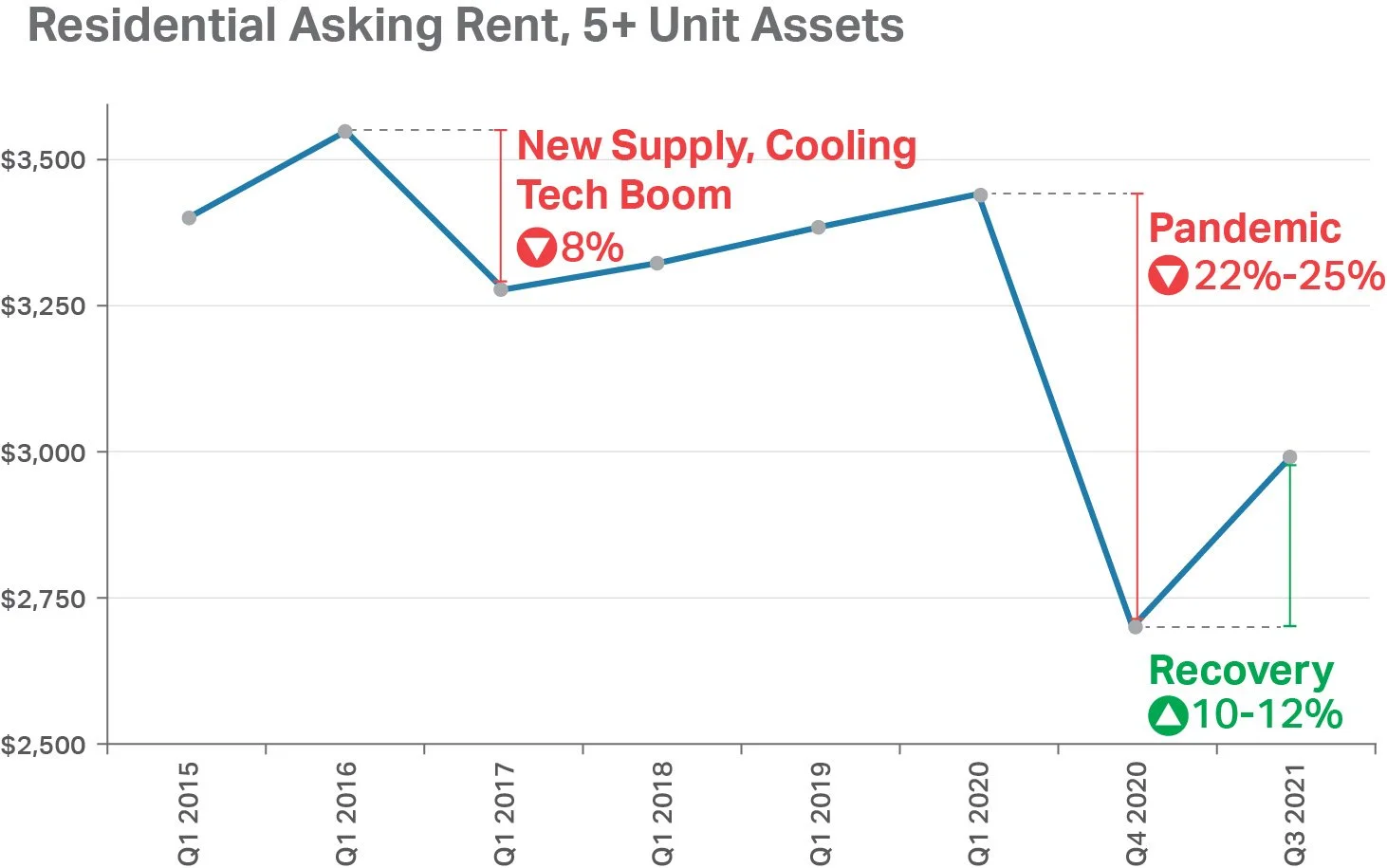

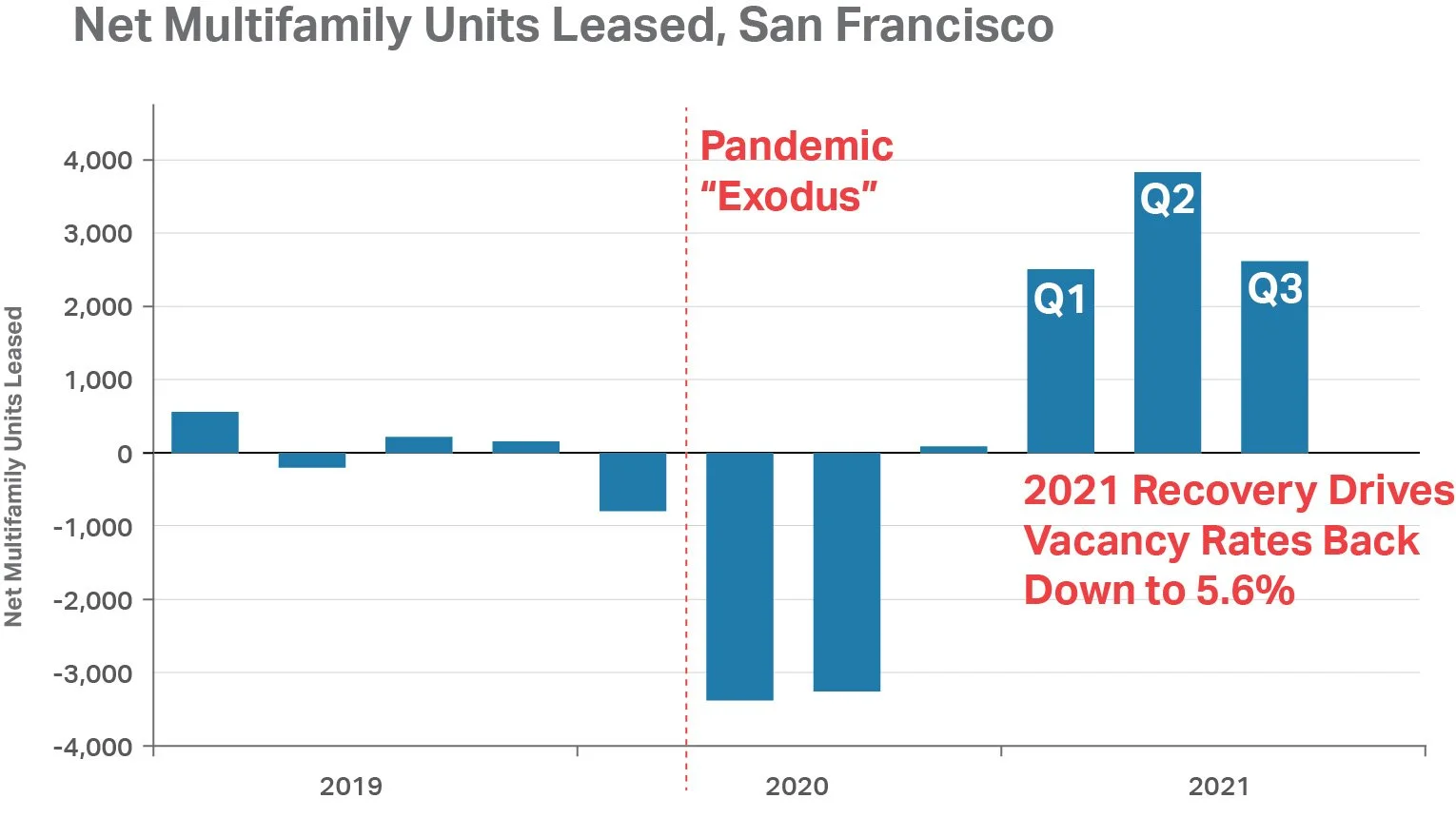

Multifamily average asking rents for 5+ unit buildings continue to rebound, it is now only down 15% from before the pandemic. YTD sales activity is exceptional, far surpassing last year during the same time period. 104 sales have close thus far in 2021 compared to just 74 by the end of Q3, 2020. Despite nationwide low office occupancy rates, the San Francisco multifamily market has remain resilient. Multifamily in the San Francisco Bay Area has bounced back strong - Vacancy rates have dropped from 7.9% in Q3 2020 to 5.6% in Q3 2021. Cap rates of recent transactions have dropped as well, from 4.9% in Q3 2020 to 4.5% in Q3 2021.

San Francisco Residential Asking Rents, 5+ Unit Assets

Net Multifamily Units Leased, San Francisco

Rent Growth, Major Markets with 75,000+ Units (Courtesy of CoStar)

Office - Leasing Activity Ramps Up, Asking Rates Stay Flat, Availability of Office Space Begins to Dwindle Again

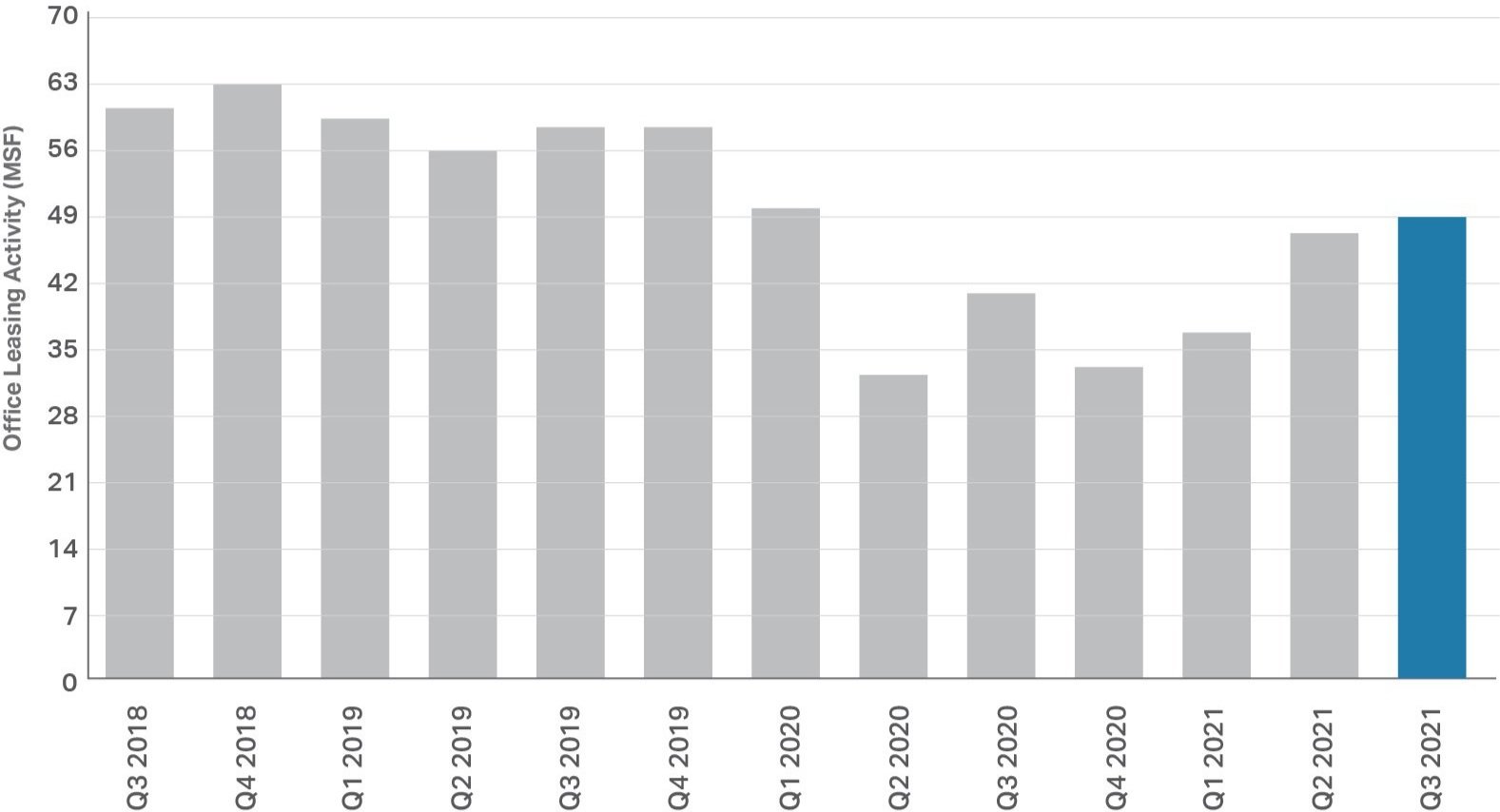

Despite being one of the slowest major market to return to the workplace, office leasing in San Francisco has recovered well. A major hiring spree in the San Francisco MSA drove unemployment down from 9.1% at the beginning of the pandemic to 4.8% in August of 2021. 2.5 million SF of office space was leased in the third quarter, a 25% increase in activity compared to Q2 2021. Direct vacancy in San Francisco stayed relatively flat at 16.7% while overall vacancy dropped 40 basis points to 26.8% as more sublease space is withdrawn or leased up. Asking rates for direct availabilities remained unchanged from Q2 at $76.08 per SF. There continues to be a flight to quality space as Class A space is the only asset class to post positive absorption at nearly 440,000 SF.

Other markets in the Bay Area have seen similar success - The San Francisco Peninsula and East Bay markets experienced positive net absorption in Q3 2021, while Silicon Valley saw minimal negative net absorption this past quarter.

Office Leasing Activity, United States

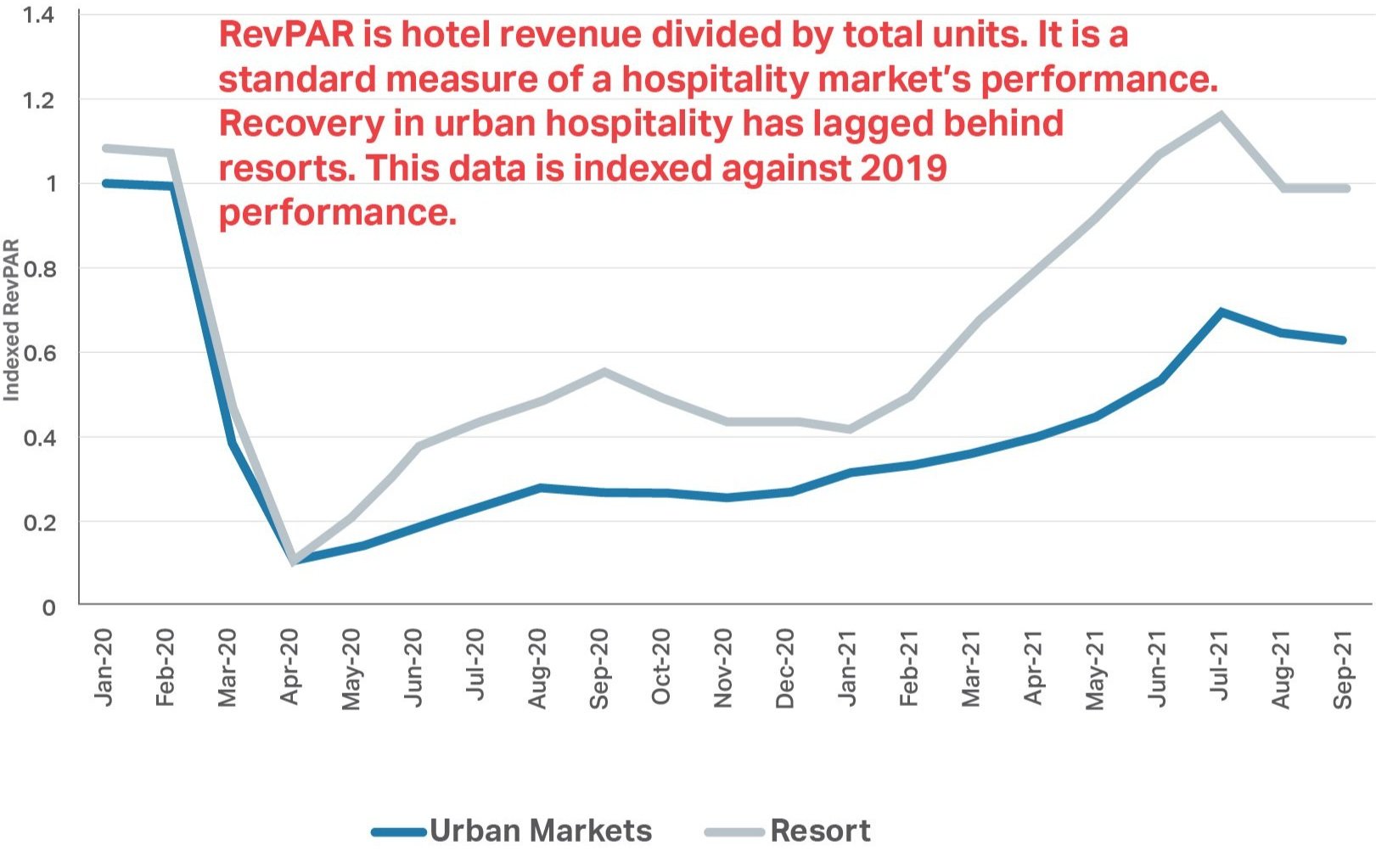

Hospitality - Recovery for San Francisco Hotels Lag Behind Other Major Tourist Markets

Eased enforcement of rules and stronger marketing campaigns in Las Vegas and many other major tourist markets has stifled the recovery of the hospitality sector in San Francisco. While Vegas is reporting visitor volume up 72.2% YoY as of the end of September, San Francisco has struggled to keep pace. Several of San Francisco’s perennial conventions have announced a move to Vegas, most notably Oracle’s OpenWorld conference and the Fancy Food Show, dealing significant blows to San Francisco’s prospects in the hospitality sector. Still, occupancy rates are now up to 53% in San Francisco, and experts in the field are bullish - “Betting against San Francisco in the long-term would be a mistake,” said Jon Bortz, CEO of Pebblebrook Hotel Trust, San Francisco’s second-largest hotel property owner.

U.S. Hospitality RevPAR (Revenue Per Available Room) Index, Urban vs. Resort Hotels

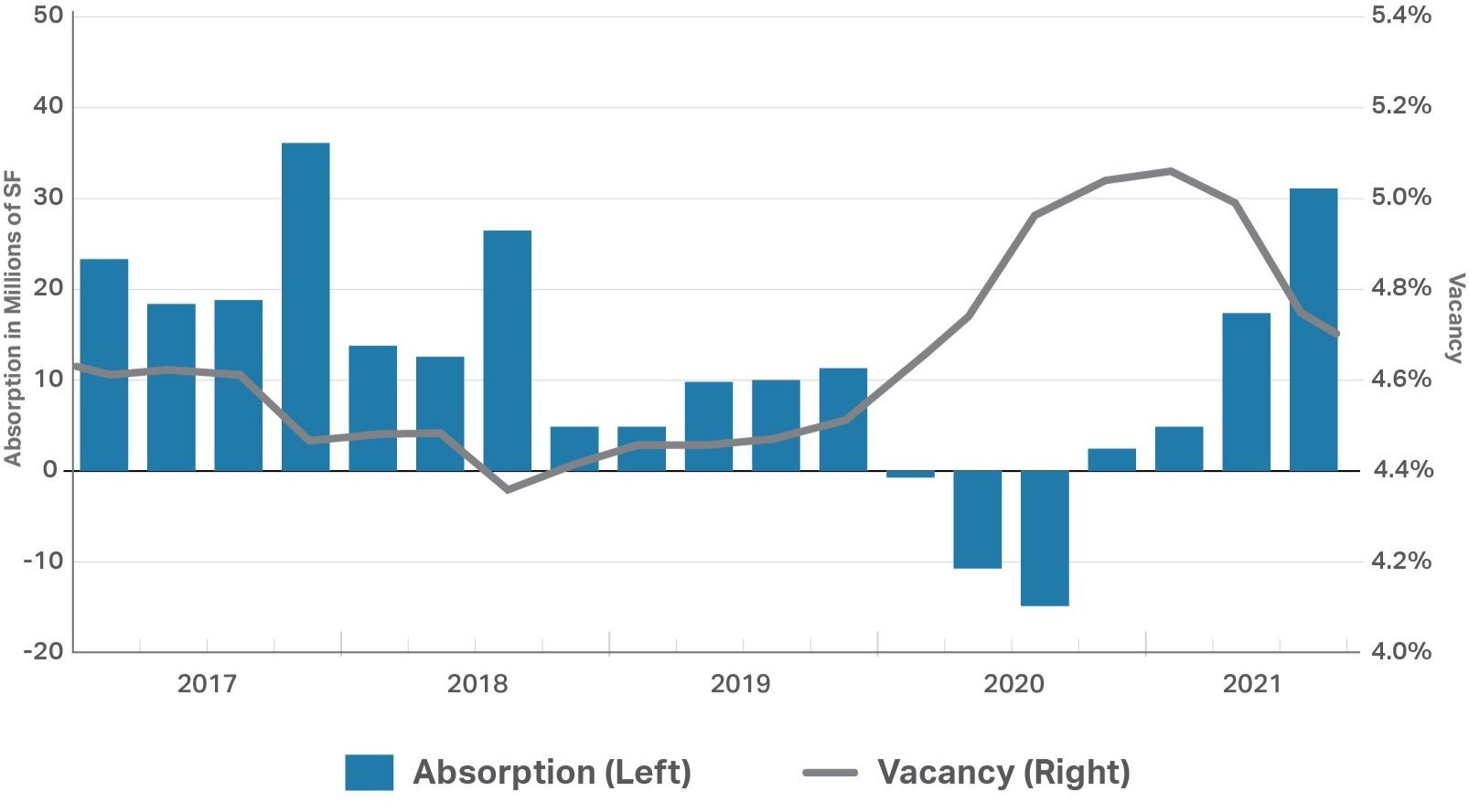

Retail - A Rapidly Evolving Landscape, And a Return to Pre-Pandemic Levels of Leasing Activity

Retail in San Francisco saw positive absorption in Q2 2021 fueled by major leases at Stonestown Galleria to Regal Cinemas, Whole Foods, and Sports Basement. Though there was 34,000 SF of negative net absorption in Q3 2021, it was significantly less than at the beginning of the pandemic - it has, in fact, returned to pre-pandemic levels of leasing activity. However, retail in San Francisco still faces its previous market challenges - formula retail restrictions, the growing threat of online sales, expensive construction costs, and an arduous local permitting process continue to put a damper on leasing prospects for this asset type throughout the region.

Nationwide, there has been a major shift in how brick-and-mortar retail is being utilized. Major retailers are transforming a larger part of their stores into fulfillment/distribution centers, creating a hybrid of retail and warehouse in one location. By 2025, experts estimate that nearly a third of of all online transactions will be fulfilled by a retail brick and mortar location, giving investors a glimpse of the future of retail.

Nationally, retail leasing activity has rebounded extraordinarily well, posting positive net absorption this quarter at a level not seen since 2017.

US Retail Leasing - Net Absorption and Vacancy Rates

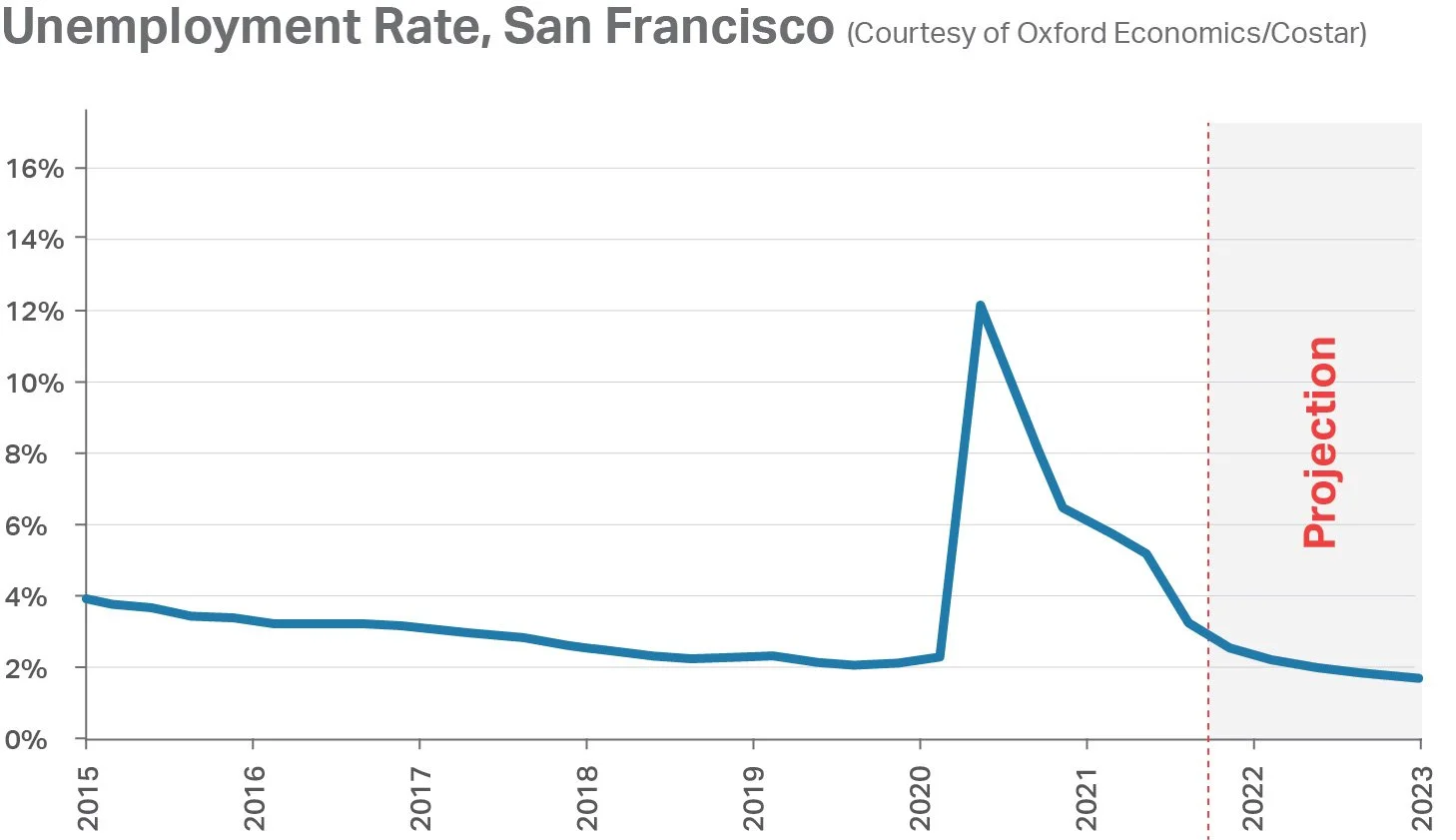

Overall Bay Area Economic Health

The unemployment rate in the Bay Area has nearly recovered to pre-pandemic levels, many returned to their old jobs or found new employment while some jobs were eliminated or outsourced to other markets. The hospitality industry suffered the greatest losses in jobs, while the information/tech sector regained the most.

Unemplyoment Rate, San Francisco (Courtesy of Oxford Economics/CoStar)

Let's Catch Up

How are your assets performing? What have been your pain points? How can we help? Let's discuss -

Call 415-288-7838

or

Featured LL CRE Group Listings

1300 Van Ness Avenue

San Francisco, CA

An Icon, Poised for Transformation

901 Kearny Street

San Francisco, CA

50-Unit Mixed-Use for Sale

$6,350,000

1723-1727 Stockton Street

San Francisco, CA

6-Unit Multifamily for Sale

$3,099,000

Legislative Update - New proposal would pave way for tenant associations in San Francisco

San Francisco tenants in buildings with at least five units could soon have the legal backing to organize.

District 3 Supervisor Aaron Peskin introduced legislation…

Recent LL CRE Group Transactions

690 Guerrero Street

San Francisco, CA

9-Unit Multifamily

932 Cabrillo Street

San Francisco, CA

6-Unit Multifamily

Pieology

Southern California

Net-Leased Retail | 1031 Exchange

Contact Us for More Information

Brian Leung

Senior Vice President

(O) 415.278.7838

Brian@LL-CRE.com

CA License No. 01203473

Jeremy Lee

Senior Vice President

(O) 415.988.9719

Jeremy@LL-CRE.com

CA License No. 01951309